Techcombank, Vietnam's fourth-largest private bank, is at the forefront of digital innovation in one of Asia's fastest-growing economies. As Vietnam experiences rapid economic growth and digitalisation, Techcombank faces the challenge of serving the country's vast network of household merchants — small, often unregistered businesses that form the backbone of the local economy.

To achieve its merchant acquisition target of 5x over two years, Techcombank partnered with Elsewhen to conduct extensive research and develop strategic recommendations that could enhance the bank's service to its vital ‘household’ merchants.

Conducted research with 15 businesses, focusing on NTB and ETB customers.

Mapped key customer pain points and opportunities.

Benchmarked 10 direct competitors and 8 global players.

Provided actionable recommendations to enhance Techcombank’s small merchant proposition.

challenge

Bridging the gap between traditional practices and digital innovation in a rapidly growing economy

Vietnam's small merchants, crucial to the country's GDP, often operate between formal and informal economies. These business owners face unique challenges that traditional banking struggles to address:

Reluctance to formally register or use business banking products

Reliance on cash transactions and manual record-keeping

Limited financial literacy and distrust of formal credit systems

Utilising familial structures to strengthen relationships among employees, accountants, and key stakeholders.

Many merchants use digital banking, but adoption of full merchant solutions remains low. QR-code payments are common yet often disconnected from a broader financial strategy.

Techcombank needed innovative solutions to serve these merchants while encouraging them to adopt tailored financial tools that simplify transactions, build trust, and provide long-term business benefits. This required streamlined payment processes, culturally nuanced banking experiences, and trust-building measures to support their unique needs.

approach

Understanding the unique landscape of Vietnam's household merchants

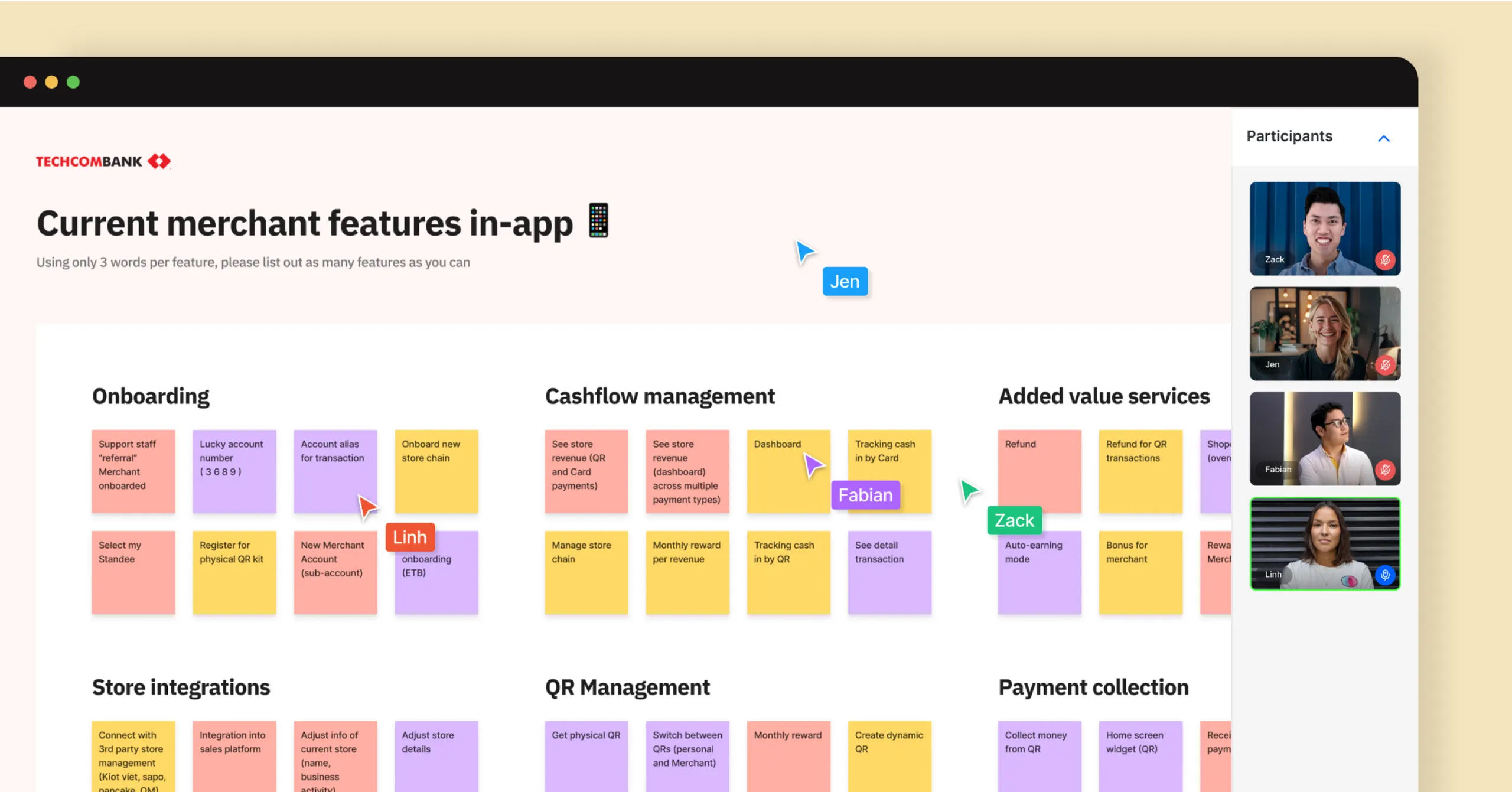

We focused on understanding Vietnam’s small merchant segment and Techcombank’s unique role in serving them. Through primary research, competitive analysis, and collaborative workshops, we identified tailored strategies to address market challenges and unlock opportunities.

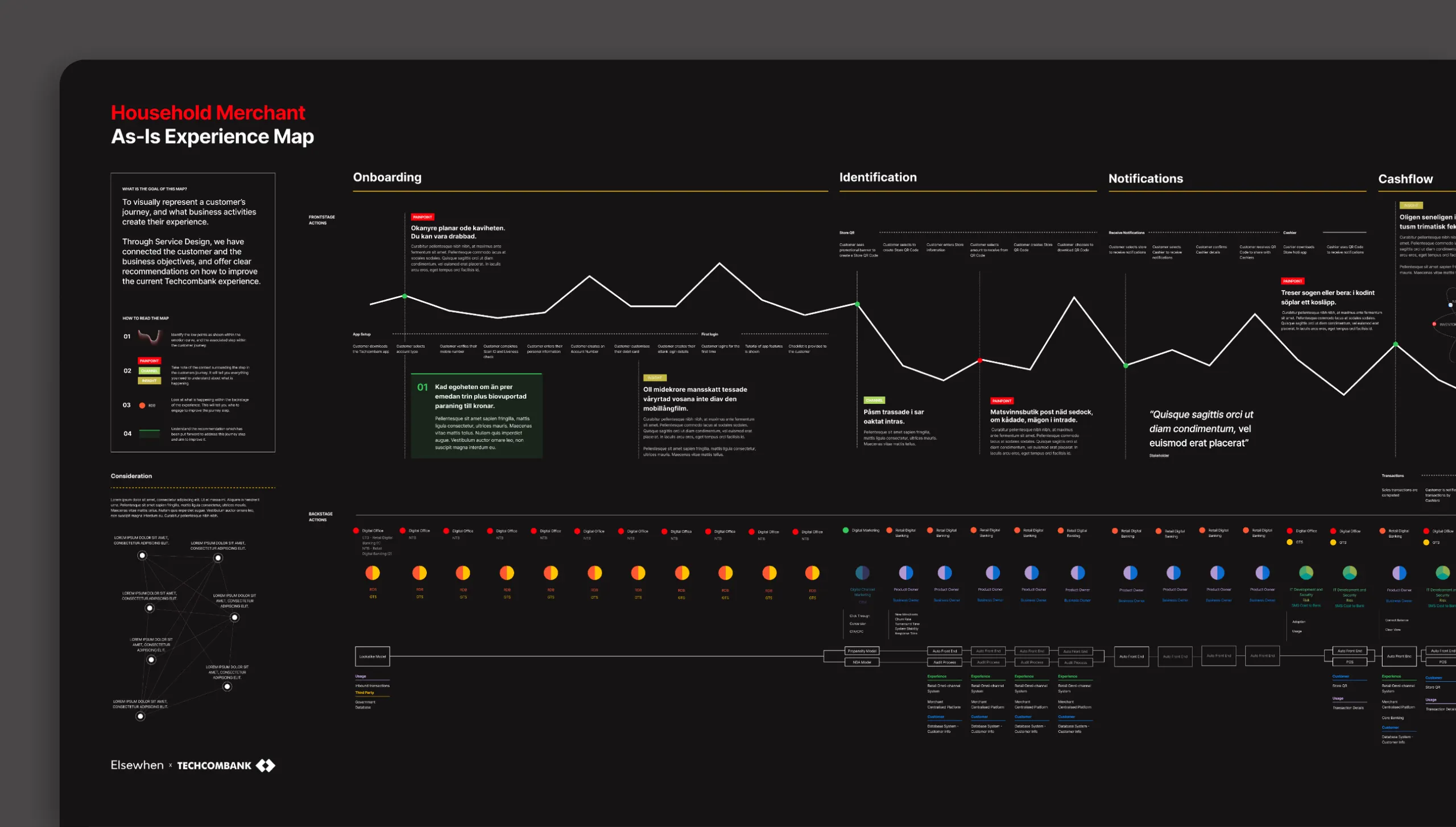

By analysing 10 local banks and 8 global players, we developed an ‘As-Is Experience Map,’ a clear visual of the competitive landscape and Techcombank’s positioning. This map highlighted key areas for differentiation and growth.

Our process delved into what motivates merchant account decisions, using these insights to guide collaborative workshops with Techcombank’s teams. The result was a unified vision and actionable strategies to serve this critical market.

solution

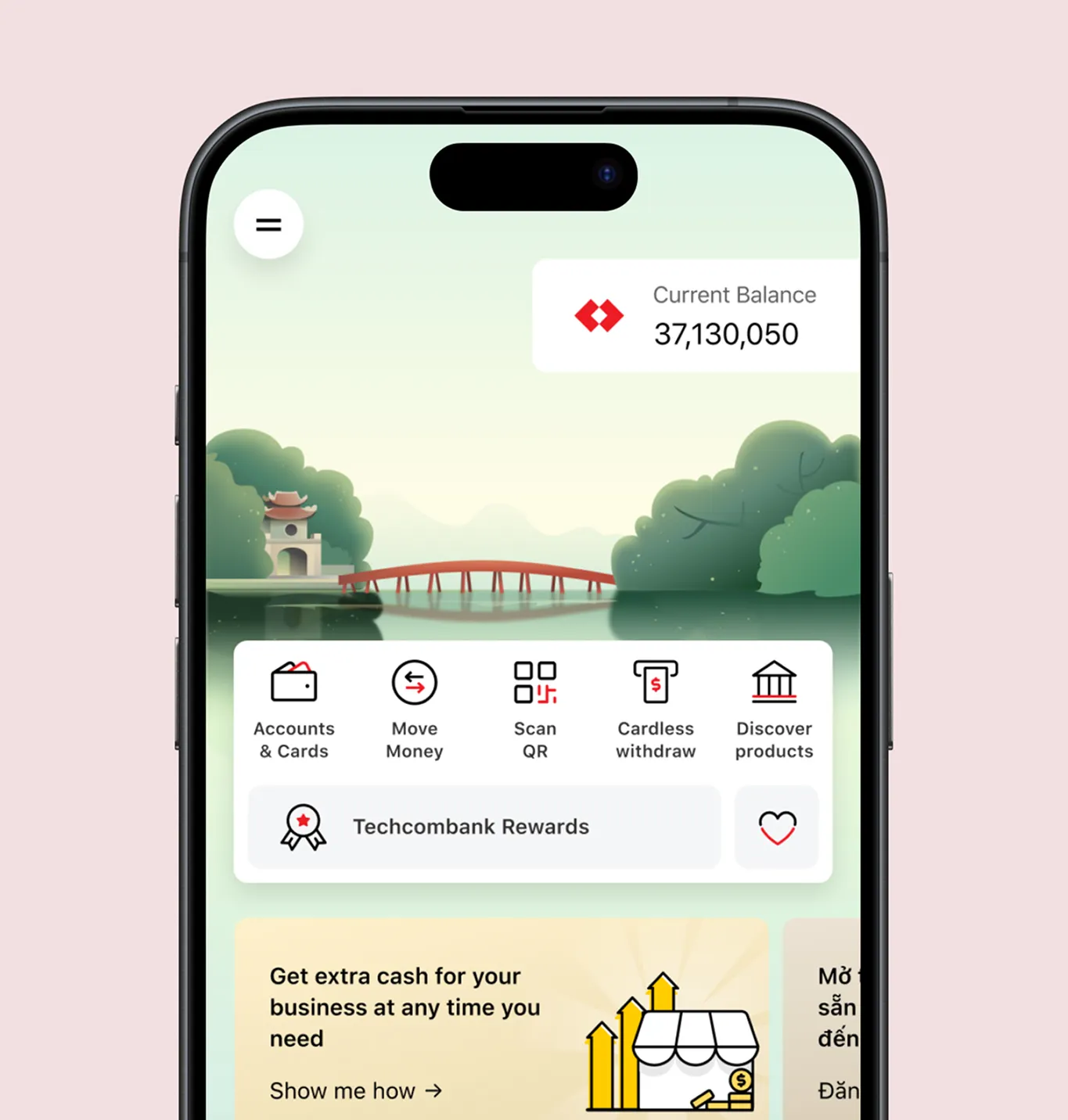

A digital ecosystem tailored for Vietnam's household merchants

Elsewhen provided strategic recommendations to help Techcombank create a digital ecosystem tailored to Vietnam’s household merchants, encouraging their transition to formal banking.

We proposed merchant-specific credit cards to address cash-heavy operations and enhanced dashboards to simplify financial management. Improved e-commerce integration supported the shift towards online sales channels among small businesses.

Our strategy built trust, educated merchants on formal banking benefits, and streamlined onboarding to highlight the advantages of business accounts. These solutions positioned Techcombank as the go-to bank for this vital market segment.

"Elsewhen quickly grasped our brief and delivered an end-to-end service that exceeded expectations, turning constraints into opportunities."

Ilko BataklievHead of Experience Design, Techcombank

outcomes

Driving digital adoption and financial inclusion

The collaboration laid the groundwork for transformative changes in serving Vietnam's household merchants. Our strategic insights and recommendations aim to foster increased digital adoption and financial inclusion in this vital economic sector.

The project has provided Techcombank with a deeper understanding of household merchants and its competitive position. These insights will guide strategies to enhance customer acquisition and retention, increase product engagement, and support the formalisation of merchant businesses — benefiting both the merchants and Vietnam’s economy.