Founders Bank aims to be the go-to bank for founders and their startup businesses. This new challenger bank is led by an entrepreneurial team of seasoned banking executives.

Many new companies operating in perceived higher-risk areas, such as fintech and cryptocurrencies, find it hard to get an account with a traditional bank. Founders Bank aims to meet this demand—as a modern digital-first financial partner to tech entrepreneurs.

Founders Bank engaged Elsewhen to create a brand suitable for their digital-first business—and implement this across the design of their banking platform and products.

We ran interactive workshops to form an agreed creative brief for the project—and build a shared understanding of creative references provided by the bank team. Together we developed a set of corporate values to form the foundation of the brand personality and positioning.

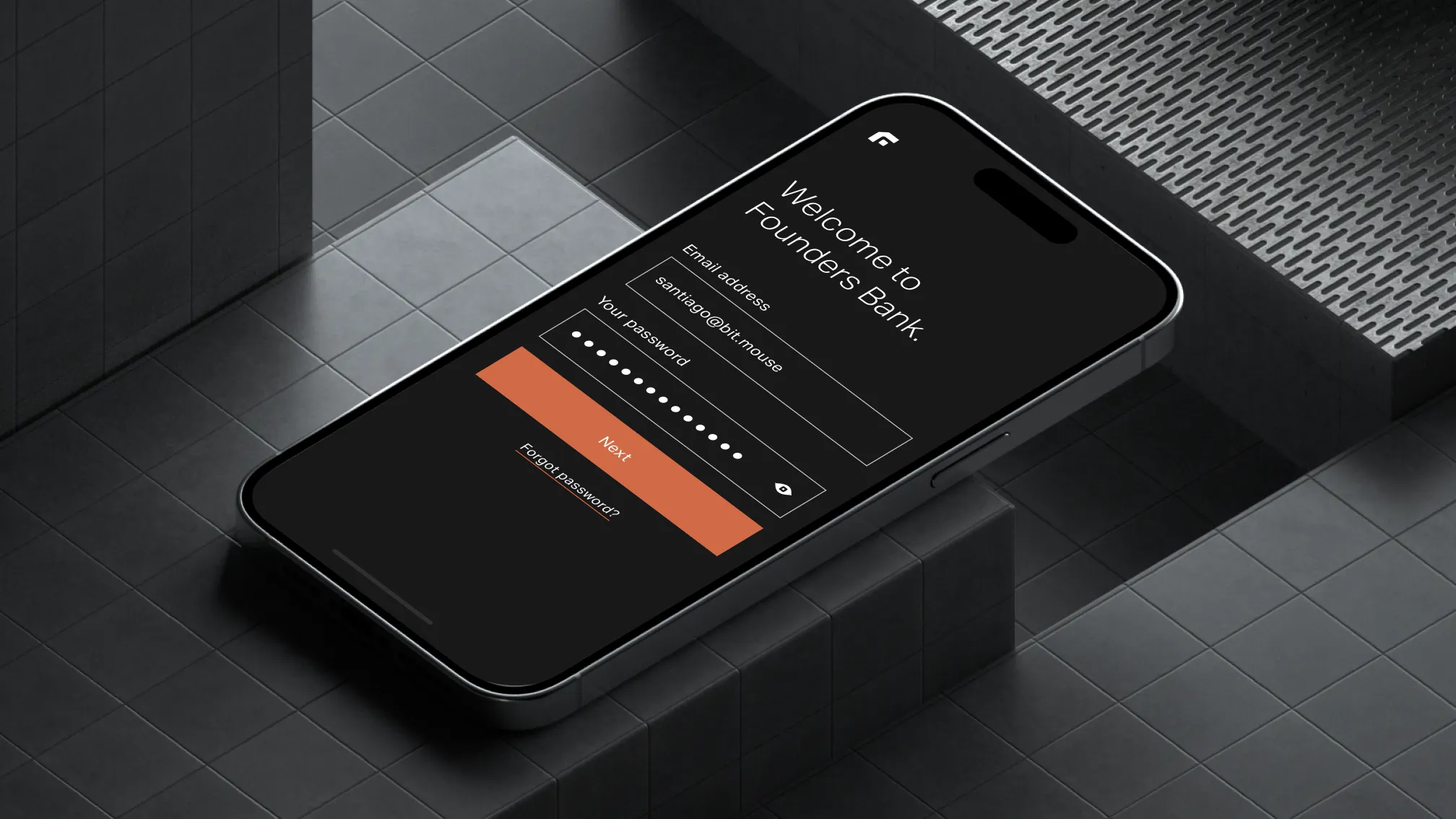

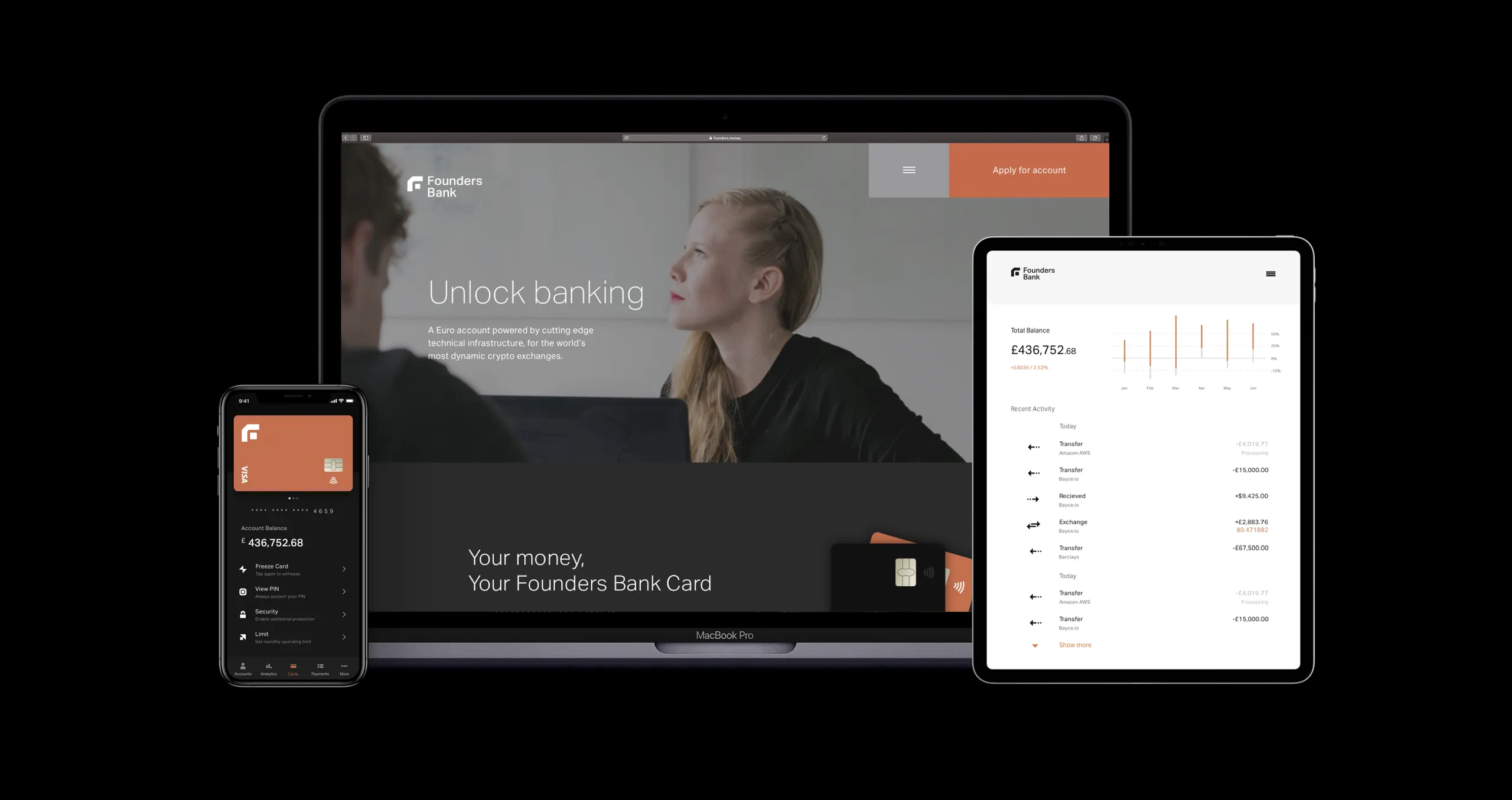

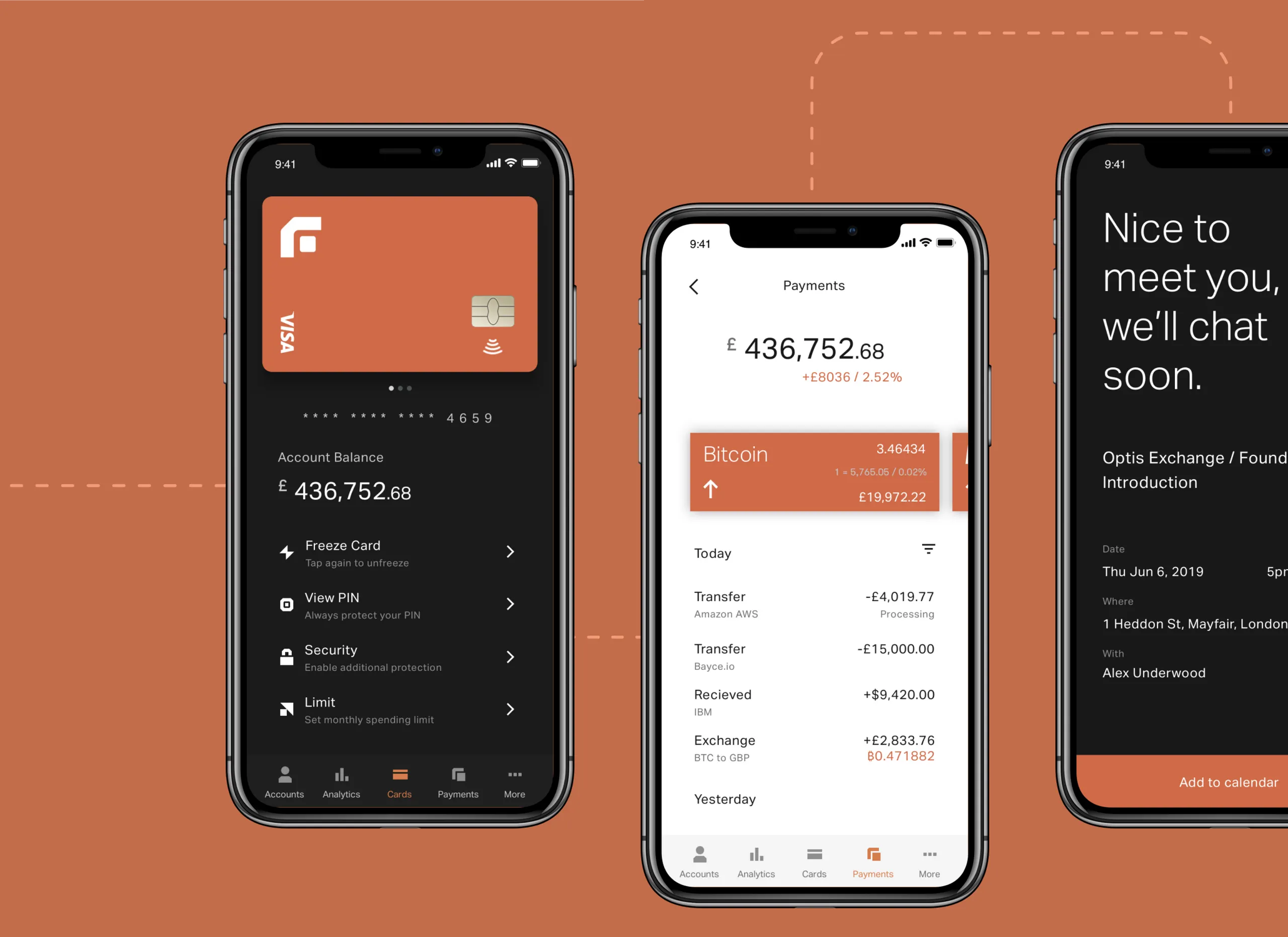

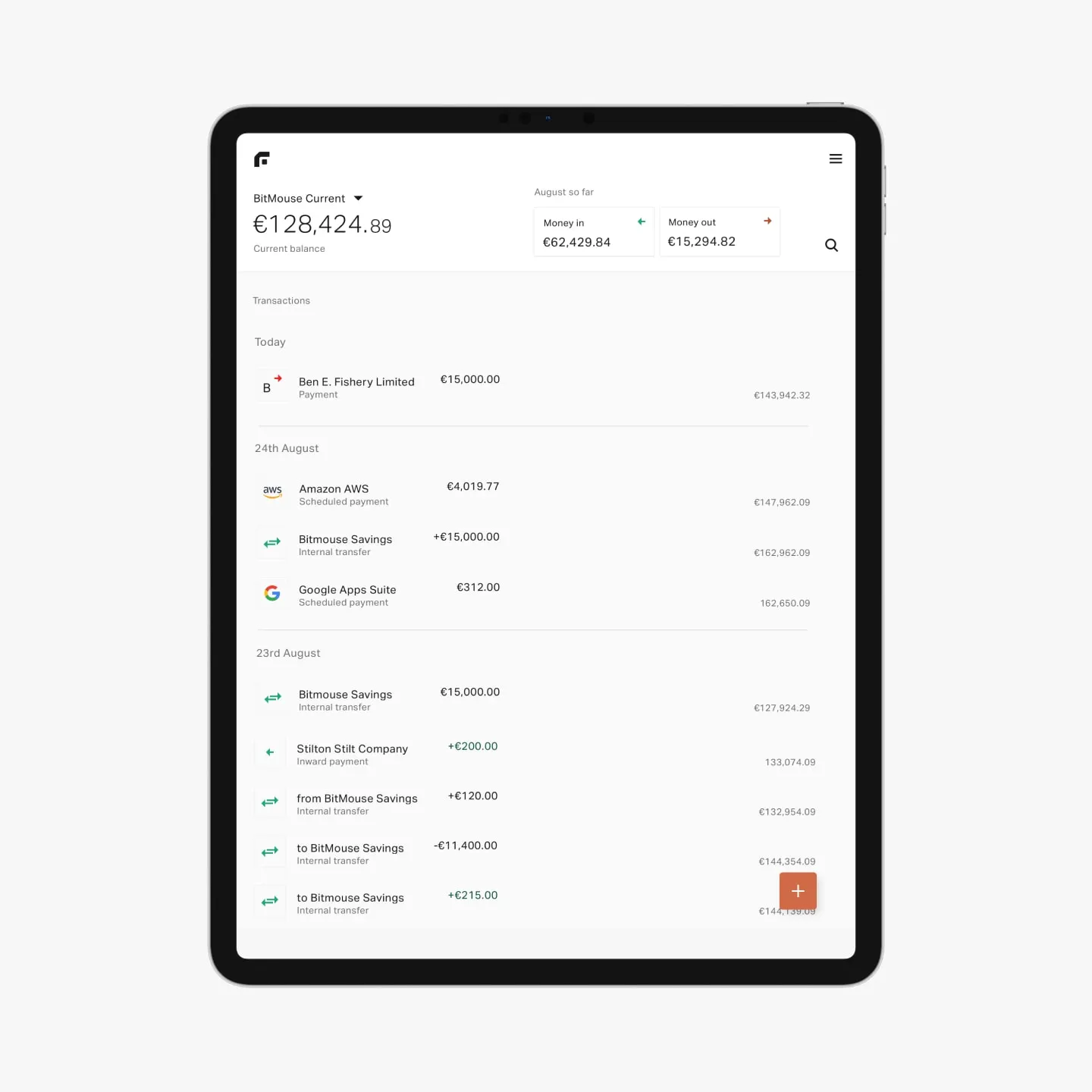

Next, we researched the expectations and needs of target customers, and mapped potential customer journeys during interactions with the bank. We used these insights to design platform concept screens for online and mobile app-based banking—providing several different creative executions of how Founders Bank could deliver their vision.

We ran feedback sessions to gather opinions from the bank team and a selection of target customers. We then narrowed down to three preferred routes, one of which was chosen as a clear winner by the bank team.

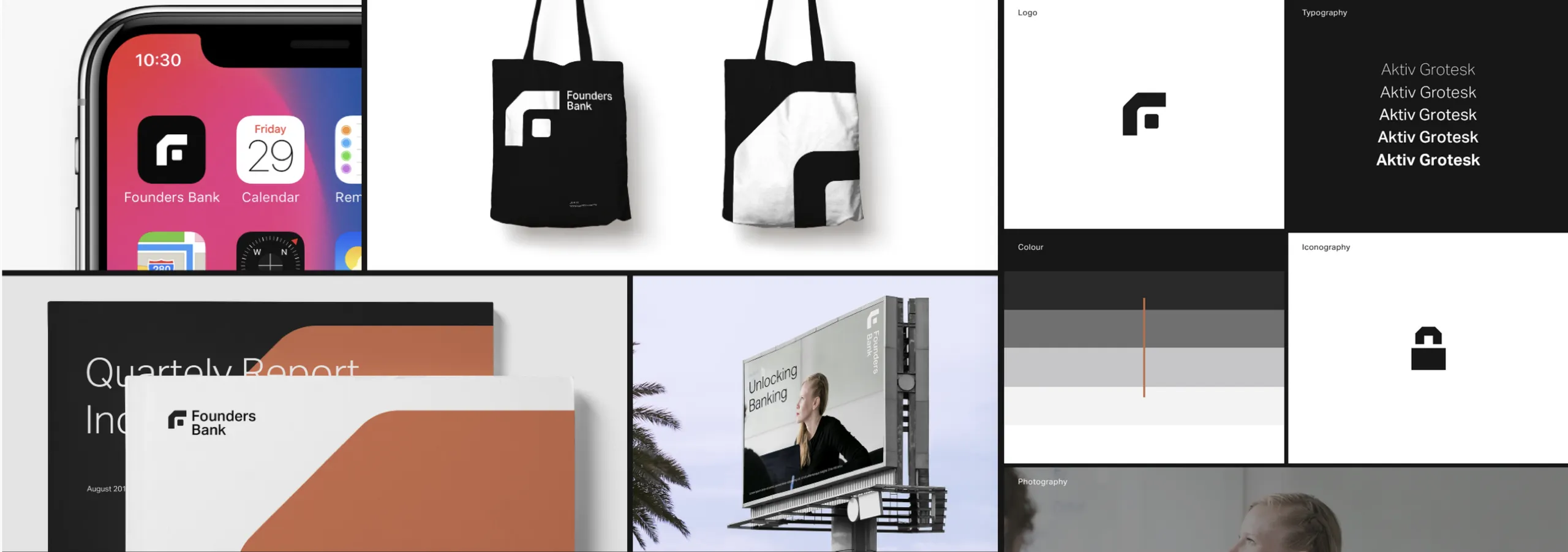

Based on the chosen route, we established a design system with rules for the creative direction of the Founders Bank brand and digital platform— with a plan for how to roll it out further to all UI, touchpoints and collateral. Our work equipped Founders Bank with a brand and platform design that perfectly reflects its positioning as a digital business innovator.

Our aim was to design a scalable brand for Founders Bank that would form the basis for the visual language across the user interface, sales collateral and marketing touchpoints. We helped Founders Bank position the brand personality, by building on the stated values and mission, and mapping out how the brand would live on the different touchpoints.

First we ran interactive workshops to create a shared understanding of creative references shared by the Founders Bank team.

Using the findings from our JTBD and user story mapping work, we designed key platform concept screens. From feedback sessions with the Founders Bank team and select CEO users, we were able to establish rules for the creative direction of the Founders Bank brand.

As a team we then continued working in sprints to roll out the creative decisions we’d made together, designing key customer journeys and template types.

We consulted on all aspects of the product and solution architecture, running a workstream in parallel to the product discovery process. This was focused on helping the bank make the right technological choices. We decided whether to ‘build vs. buy’ for each component or product, consulting with Founders on the tradeoffs and risks in respect to particular technical decisions that had to be made before execution starts.

We were at once fleshing out the practical proposition for its desirability, feasibility and viability, considering potential pivots that might be required in the future, and taking into account time-to-market requirements. To meet these time-to-market requirements, we made a decision to use third-party providers when possible, and focus our efforts on ensuring smooth orchestration of services. Being API-led, we also needed to ensure that we will be exposing certain services to the world while keeping others internally.

The market for tech products that could support our requirements is quite broad, so to select the most suitable vendors to work with, we ran a due-diligence process for services which are core to our offering. Among other aspects, we inspected API availability, readiness and documentation as part of initial vendor due diligence. Where possible, we used a combination of our already existing relationships and expertise to recommend potential partners that can satisfy requirements and key APIs we could utilise.

Where we were instead developing our own technology, we defined in detail how it would function and integrate internally and externally. The final decisions were captured in an architectural document corresponding to the roadmap, customer journey and prototype.

We delivered the Founders Bank team a solid plan that outlined a unified strategy, value proposition, execution roadmap and a high fidelity prototype. The plan was communicated in detail with the stakeholders and signed off. This allowed us to move to the next phase, the Implementation phase.

No plan survives contact with reality, however planning is paramount. Once we commenced Implementation, the ability to release software often and react to change became the key policy for our team. Elsewhen became the Founders Bank product team (from an IT perspective).

Our multidisciplinary team of product managers, product designers, front and backend engineers worked in two week Agile sprints to implement the Roadmap. The Roadmap itself was a living artifact, meaning it was constantly evolving to respond to the reality that the team encountered.

The design team moved slightly ahead of the engineering team to define user stories, making decisions on delivering value so it always positively impacts the users. We released software daily to the cloud environment, allowing us to concentrate on producing working software, and every two weeks demo to the stakeholders the progress the team is making.

We used the latest technologies and methodologies to be able to move quickly through the backlog. From the design perspective we bypassed wireframes, instead working directly into high fidelity designs that become the cornerstone of the user stories. The designs were executed in a collaborative design and prototyping tool Figma. The user stories are then worked on by Frontend and Backend engineers to deliver the API and web components that satisfy the acceptance Tests. Automated testing is securing the code through the change iterations. At every code push and integration, test suites are executed by a continuous integration server to insure stability and quality assurance. In parallel to this work, our team continued to configure the acquired capabilities such as the core banking system.

Our product, design and engineering consultants are all working directly with the stakeholders. This means that every person on the team has an understanding of the business context and the customer needs directly. This is a much more effective, streamlined and inclusive way of working. This agile collaborative approach to software engineering ensures that we deliver value fast at the highest level of quality.

In conclusion Founders Bank aimed to be the go-to bank for founders and their businesses. We delivered a plan that encompassed a unified strategy, a value proposition, an execution roadmap and a high fidelity prototype. The plan was signed off, allowing us to move into the Implementation phase.