Real-time data can enable better risk management for your business and more value for your customers – as Elsehwen recently achieved for insurtech Zego.

Industry innovator Zego is a preferred motor insurance partner to ride-hailing services like Uber, Freenow and Bolt, as well as food delivery apps such as Uber Eats, Just Eat and Deliveroo. Drivers of private hire vehicles, delivery scooters and vans can buy fast and fairly-priced cover from Zego via its app or website.

As an evolution of its digitally-enabled offering, Zego wanted to use app-based telematics technology to identify and reduce risk for customers, through helping them improve their driving behaviour. But there were many challenges for Elsewhen to help Zego overcome.

Data, the fuel of business

Data is now seen as “the new oil” for all kinds of companies. But in the insurance industry, this is nothing new. Insurers have always been dependent on accurate data to power their business model.

This has conventionally been historical or statistical data. For example, motor insurance underwriters traditionally determine a policy price based on the type and age of the vehicle, the driver’s history of claims, and their record of driving offences – but also on factors such as the driver’s age, gender, job and home area. These would be used in an attempt to statistically forecast the likelihood of the driver making a claim.

However, until recently, motor insurers had no direct evidence or insight into perhaps the most important question – is a specific customer actually a safe and responsible driver?

Today, insurers can go beyond just using historical data. They can access and analyse a much wider variety of data sources – even real-time data. Modern analytics tools and AI can enable insurers to derive new insights and value from this data, which they can apply to improve their processes, better understand their customers – and create new products to meet customers’ evolving needs.

The emerging ability to manage risk in real-time using data analytics is giving insurers new ways to improve profitability and business agility – while also enabling a completely new type of data-driven insurance product based on telematics.

Enabling real-time telematics data insights

Telematics is a technological method of monitoring vehicles and other assets – using electronic sensors that report metrics such as GPS location, speed and acceleration.

Automotive telematics originally required a ‘black box’ device to be installed in the vehicle – which was usually connected to the on-board diagnostics (OBD) system to record additional data from vehicle sensors.

Today, however, most drivers carry a smartphone equipped with GPS, accelerometer and many other sensors. So telematics can now be more easily deployed via a mobile app – with the added advantage that the smartphone can send the collected driving data over the mobile network, automatically in real-time.

Photo: Unsplash

In recent years, insurers have recognised the huge potential of automotive telematics to enable a new kind of motor insurance policy. In telematics-based motor insurance, a driver agrees to allow a device or app to monitor their driving behaviour and habits – in exchange for potentially lower-cost insurance.

Driving data-powered benefits

Telematics-based insurance brings a range of benefits for both the insurer and the customer:

Fairer, more accurate pricing

The insurer is able to access detailed real-time data about the customer’s driving behaviour – in order to give the most fair and accurate price against the likely level of risk. This in turn can improve the insurer’s profitability and ratios, as they can more accurately match rates to risks, and reduce the scale of claims overall. The insurer is also empowered to offer customers the most competitive pricing – rewarding those who prove their safer driving behaviour.

More transparent pricing decisions

Customers for traditional motor insurance are often mystified by the wildly varying prices of quotes they receive. With telematics-based insurance enabling greater transparency, a driver can clearly see how their driving behaviour and risk level influences the price of their cover.

Incentivising safer driving

Better, safer driving is in the best interests of both the driver and the insurer – as well as other road users. With an app-based telematics product, insurers can encourage and coach careful driving, with in-app tips and messaging. Improvements in driving can be incentivised – for example, by saying that improving a specific behaviour could cut your premium by a certain percentage. As well as helping reduce claims from driving incidents, this personalised and data-driven advice can help drivers mitigate vehicle maintenance and repair costs – such as by avoiding excessive wear on brakes, clutch or tyres.

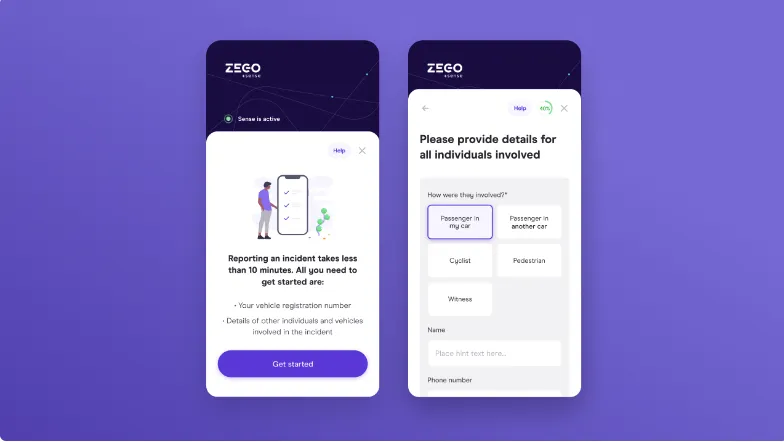

Photo: Elsewhen

Improving the claims process

Another benefit of app-based telematics for both insurer and customer is that it can accelerate and enhance the claims process. In the event of a driving incident, the telematics app can detect extreme deceleration – and alert the insurer to the situation. This enables the insurer to offer the driver immediate assistance – or advise the emergency services if needed. It can also provide the earliest possible First Notice of Loss (FNOL) for the insurer – enabling a faster claims process and automatic arrangement of repairs for the customer.

Building engagement and loyalty

By making the customer an active agent in determining their own insurance costs, insurers also make drivers more deeply engaged with them. Customers will feel incentivised to reap the rewards of their careful driving – and to stay loyal to the insurer that offers personalised low prices.

Getting a telematics product on the road

Zego had identified that by using app-based telematics data, there was an opportunity to significantly reduce costs associated directly with driver insurance claims. Understanding individual risk and reducing the cost of claims could also help improve Zego's ability to price its products and policies more fairly – providing better outcomes for customers.

However, telematics is currently perceived by many drivers as an intrusive technology. Drivers can be reluctant to install an app that is constantly tracking them, and may see little incentive to improve their driving. It is also difficult to retain app users and consistently collect telematics data, with many users uninstalling apps after a few weeks.

Elsewhen helped Zego to overcome these challenges – and accelerate its app-based program to market readiness in a timescale of just 10 weeks. During the product’s first month, more than 3000 of the new ‘Sense’ telematics policies were sold, successfully meeting Zego’s launch objectives. The telematics app has also earned a user rating of 4.7 out of 5 on the Apple AppStore (as of January 2022).

Explore our case studies to learn more

Elsewhen is a digital product consultancy based in London, UK. As a digital product consultancy partner to leading global brands, our services include digital transformation, strategy and product design consulting.

Find out more about how Elsewhen helped Zego successfully launch a new app-based telematics insurance product.