Financial services firm Capitalflow launched in 2016 as a lender to SME businesses in the Irish market. It is positioned as an alternative to the major Irish banks (such as Bank of Ireland or AIB) and has become Ireland’s fastest-growing alternative lender, serving more than 2000 business customers.

Capitalflow appointed Elsewhen to conduct a review of its current processes and technology to ascertain the best approach to achieve its growth ambitions – over the next 3–5 years to be Ireland’s leading SME lending provider.

Value proposition creation

Service Design

Product architecture

Technical solution architecture

Data modelling

Roadmap creation

Design for key customer journeys

Moving from manual processes to seamless digital experience

With over €450 million (£375 million) of lending already provided; Capitalflow now wanted to double this figure. The business had launched with an attractive offering to customers – but its underlying technology infrastructure was holding it back from the next phase of growth.

The company’s lending process was based on a complex mix of manual activities, requiring phone calls, emails, Word files, paper documents, PDFs and spreadsheets. Receiving a customer lending application, assessing this, making a decision and transferring capital could take weeks.

Capitalflow wanted to move away from this disjointed state to a new approach – connecting with their customers digitally end-to-end. They needed to go from manual processes to a digital platform providing a better experience for both customers and staff.

Designing a platform and customer experience to enable growth

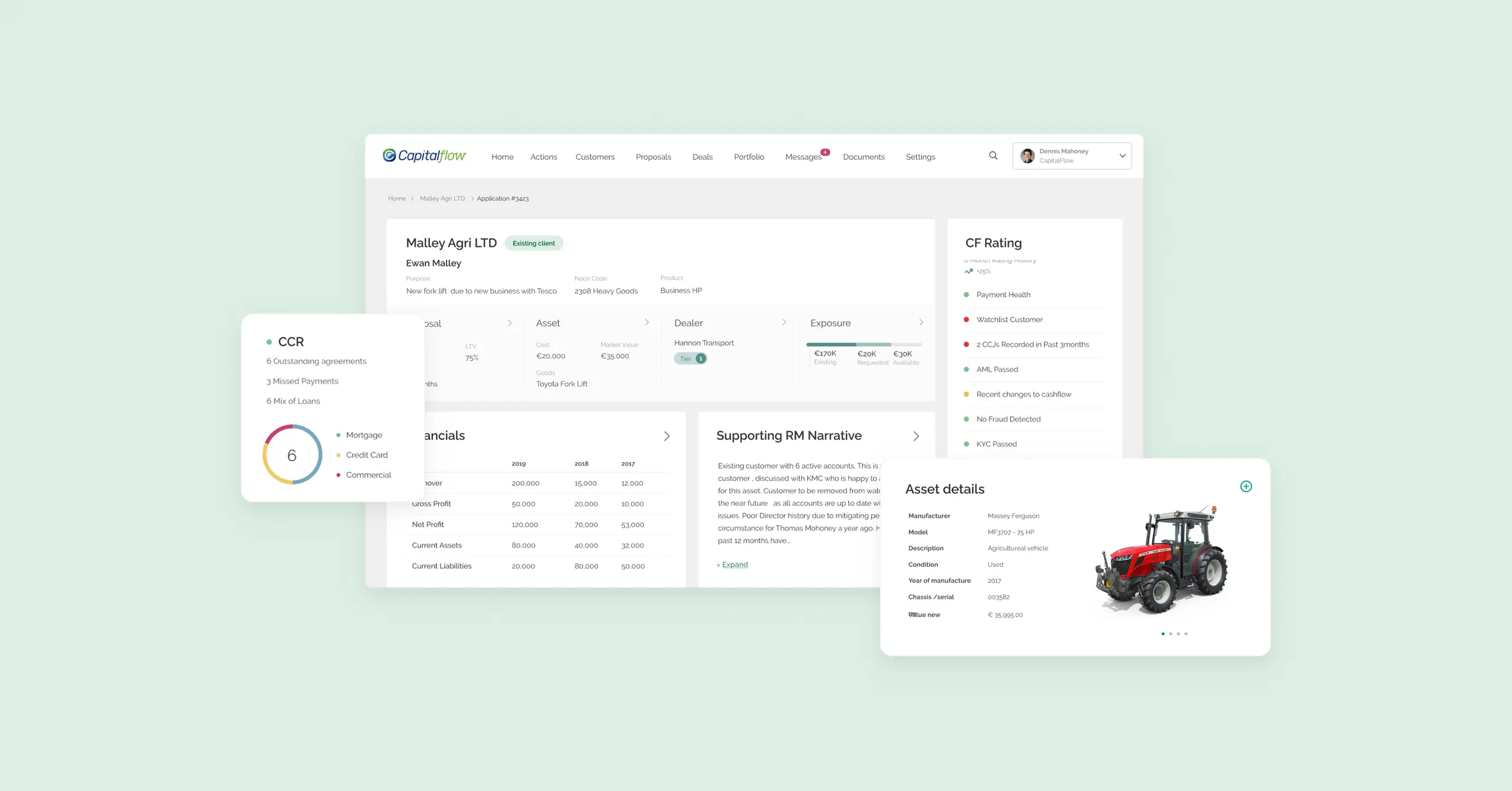

Capitalflow turned to Elsewhen to help them architect a new streamlined customer journey for lending. We worked closely with Capitalflow to analyse and determine the key pieces in a new technical architecture that would be needed to achieve its ambitious goals.

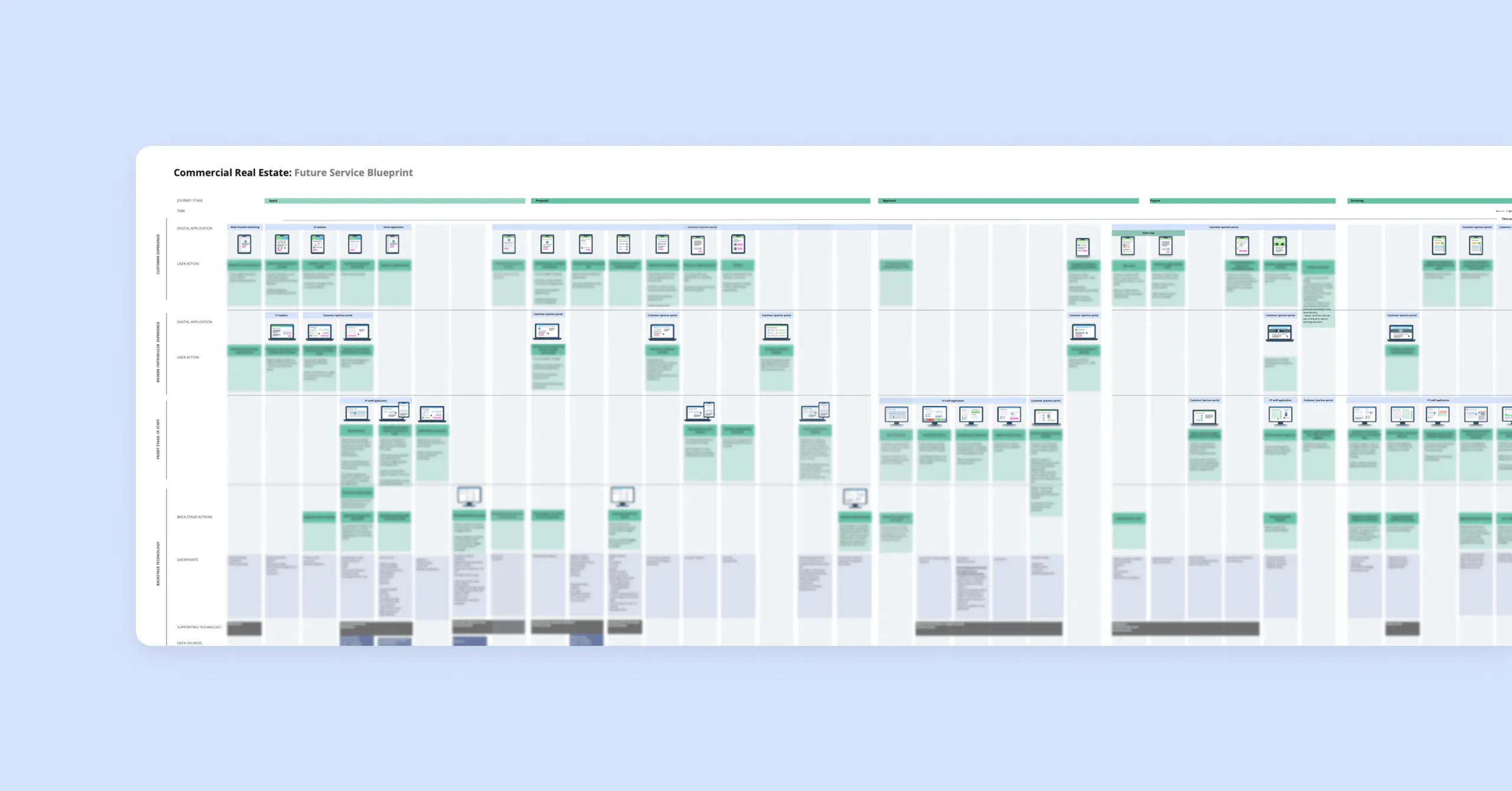

Elsewhen mapped out the current business processes and workflows, and conducted over 40 interviews with staff, customers and partners. Our team assessed Capitalflow’s existing technology to understand which elements might support growth plans.

We designed the future state of the business platform as a service blueprint. To define a new digital infrastructure, we researched the market to shortlist potential technology providers. We then produced an implementation plan to deliver the digital transformation within a 12-month schedule.

Bringing technology together into a customer-centric platform

Elsewhen gave Capitalflow a complete action-oriented strategy to build its new digital platform. Our approach ensured business continuity and minimised disruption during a safe migration of customers onto the new digital platform.

Our technology assessment provided due diligence for the shortlisted vendors: These new digital infrastructure components are connected using modern APIs and algorithms – so processes and decisions can happen in real-time, rather than taking days or weeks.

Capitalflow now has the strategy for a scalable digital platform to improve customer experience, gain greater market share, better identify market opportunities – and roll out new offerings quickly to take advantage of these.

Delighting SME customers and growing revenue

Digital transformation is enabling the path forward for Capitalflow – to achieve its ambition of becoming the leading SME lender in the Irish market. With the implementation of a new agile and scalable digital platform, it can give customers a best-in-class experience.

Customers can get a faster lending decision with Capitalflow’s new automated underwriting process. This now uses APIs to quickly calculate the customer’s eligibility based on a range of data points. Automation has also increased the potential to cross-sell and up-sell other products to eligible customers.

Capitalflow’s new digital platform streamlines the operational complexity of the business, allowing it to scale more easily. Our work provided significant improvements in operational efficiency and a major opportunity for future growth.