The SME lending space has provided a unique battle ground for existing and new players.

Players we have discussed earlier such as OakNorth and iwoca have filled a huge funding gap for SMEs. While this is certainly a huge step forward, the customer experience gap in SME lending remains.

When I think about what a great customer experience looks like, I think about three key components:

Personalisation, which is core to a great customer experience, is all about providing a moment in an experience that is personal to the customer

Relevance, which is all about providing a service or feature that matters.

Predictability, which is all about supporting the customer in a way which makes something better for them in the future.

Leading players in the consumer banking space, from Monzo, TMRW Bank, Bank of America to Capital One have all created exceptional experiences that encompass all of these factors. In this article we will highlight who is creating excellent customer experiences in the SME lending space, highlight what lenders can take from the consumer lending space, and highlight a wildcard player which may shake up the way we think about business lending.

Relevance: How Fundbox makes relevant lending opportunities based on outstanding invoices

An experience that is relevant does not necessarily need to be personalised. Better examples of relevance in CX tend to come from the e-commerce space, where they promote clothing based on the current weather or recent browsing patterns. In banking, inspiration can be found in how some banks offer relevant information, product or services based on the user’s travel plans.

The wave of fintechs that are tackling the lending gap via new ways of invoice financing are offering relevant experiences via their service design. Fundbox, a US-based fintech, is a great example.

Fundbox doesn’t offer the standard business loan, instead its value proposition offers SMEs access to invoice financing and lines of credits based on outstanding invoices. It offers two core services:

Fundbox Credit (Invoice Financing)

Direct Draw (lines of credit)

To become a customer, businesses connect Fundbox to their bank account or accounting software and answer some basic information about the business. If approved, the funding is available almost immediately, with no credit check. Businesses then pay back Fundbox in equal instalments over the course of the 12 or 24-week plan, with no penalties for early repayments.

Relevance:

The solution is inherently relevant to both the type of business (hyper-focussed on new and smaller businesses), but also the credit available is based on the businesses outstanding invoices. It is directly tied to outstanding invoices, making it the right amount of potential credit at the right time.

The Fundbox dashboard shows them the information that matters to them, and every choice is directly linked to invoice and thus credit management.

Personalisation: Winning with the hybrid model

As we mentioned previously, UK unicorn OakNorth takes a highly personalised approach to lending, offering 100% personalised solutions and incorporating human credit committees. This involves a digital / human hybrid model which is key to personalisation in the SME lending space. While it’s easy to be dismissive of new players which are not 100% digital or automated, the human element is incredibly vital for achieving elements of personalisation.

Another example of a leader taking this hybrid approach to lending is OnDeck. While from the initial onset, OnDeck looks very different to an iwoca, as they are “Part high tech. Part human.” The tech part comes from the proprietary software used to aggregate data about a business’ operations, which is then processed by algorithms to determine loan eligibility. In addition OnDeck aims to give same-day decisions, with disbursement in one to two days.

The human part comes in the form of a dedicated loan expert to discuss a loan tailored to the business. Furthermore, OnDeck reports payments to bureaus so that on-time payments can help build business credit, a fantastic example of going above and beyond the core product.

Predictability: Bettering the customer’s future with smart data

SME lenders, and to an extent lenders in general, struggle to incorporate elements of predictability to enhance the customer experience. However, there is ample opportunity for business banks with lending products or account aggregators with lending partners or services to take advantage of the data they have to create a great experience via predictive elements.

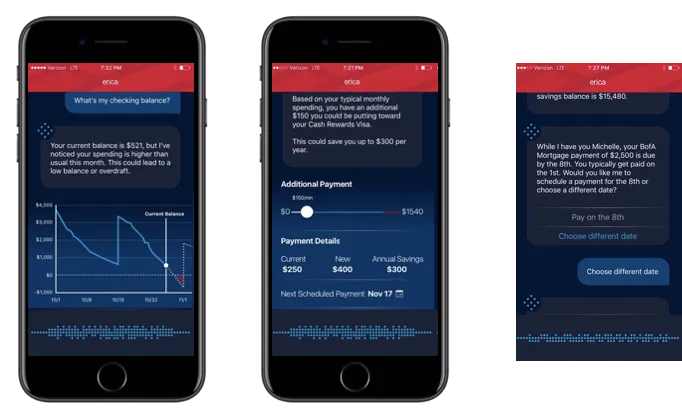

Bank of America’s virtual assistant Erica provides fantastic experiences to customers based on existing account spend. For example, the assistant can see when spend is higher than usual and inform users that an overdraft may be required. It also does exactly what we talked about in the article 'Beyond SME Lending' around smart data, by telling customers about the extra cash they could put towards an outstanding credit card balance.

There is one wildcard in the SME lending space which could revolutionise for both lenders and SMEs and it is incredibly data driven. The Helio solution from CircleUp, a fintech that focuses on consumer goods startups. Apart from Helio, CircleUp provides equity, credit or both as well as a vast network of entrepreneurs, institutional investors and industry experts.

The Helio solution is a machine learning platform that identifies, classifies and evaluates early-stage consumer and retail companies to identify potential breakout brands. Helio extracts data from hundreds of sources to spot early innovation, and this can help lenders in the loan-underwriting process. By incorporating this modeling to understand future performance of current clients in the consumer good industry, lenders can start to predict potential lending needs, whether the company is predicted to breakout, or face a rough few months, and thus offer an incredible experience based on personalisation, and smart data.

The key to success: focus on the customer experience

Innovators in the SME lending space have rightfully built their products and services to tackle the core issue at hand: SMEs’ lack of credit. This space was traditionally dominated by big banks, which neglected SMEs to begin with, let alone the provision of credit, and the means in which it was dispersed. By simply offering access to credit, in a way that is convenient for SMEs and dispersed quickly and easily, innovators in this space have enhanced the customer experience.

However this space is filled with innovators who have revolutionised the types of lending available and what types of SMEs can access credit. In order to truly stand out, as and when the market becomes saturated and pricing becomes less sensitive, customer experience will be a deciding factor as to who wins. By providing highly relevant experiences and platforms, lenders can save SMEs time and reduce the administrative burden. Taking a digital and human approach to the application and servicing journeys can provide a much needed human touch for early stage businesses, those with more complicated lending needs, or those who miss that human touch which has disappeared in the broader fintech revolution. Lastly, lenders can truly set themselves apart by taking on elements of predictability in their experiences or services, by incorporating smart data.

Photography — Joshua Golde on Unsplash