In Europe and the US, there is a growing segment of ‘mass affluent’ investors who remain underserved by the wealth management industry. Consulting firm Charles River Associates, via the FS team at their subsidiary Marakon, had an opportunity to change that.

They had developed a unique wealth and asset management model in-house, and they wanted to turn this intellectual property into an elegant digital product for their partners and their partners’ customers to use.

Their retirement investment model was initially defined in Excel sheets, which Elsewhen would need to quickly comprehend and translate into robust code. This code would then live under an interface we would prototype and test with users, before being refined and delivered to users through a delightful customer experience.

Lean workshops

Algorithm design

Customer experience

Lean brand

UI & Interaction design

Roadmap definition

Web development

Systems architecture

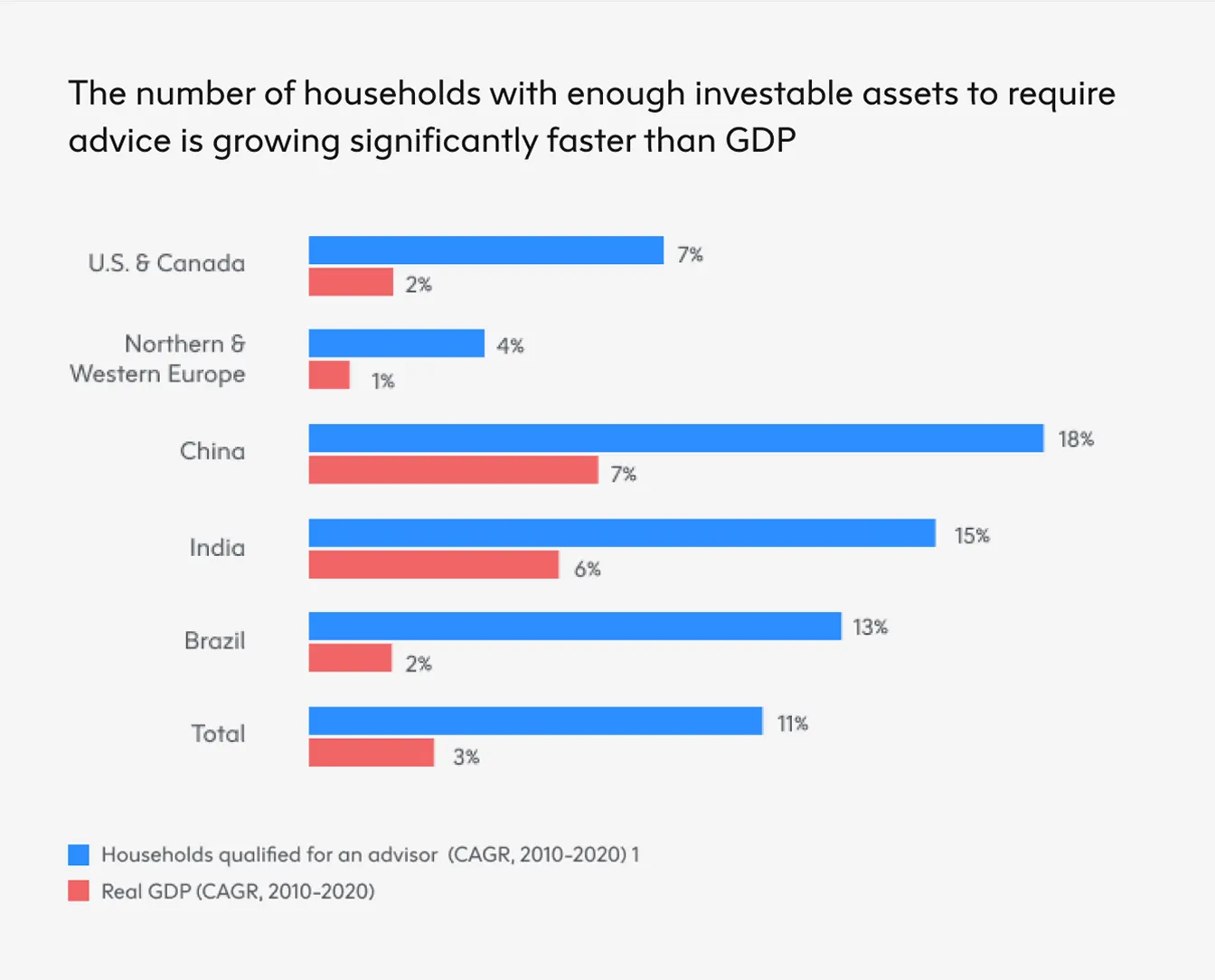

The emergence of the ‘mass affluent‘

The mass affluent customer segment can be quickly defined as individuals or households with significant investing potential—either in income or assets—but with a total value of under a million pounds or dollars. In the US, they can also be grouped as having significant 401(k) pension plans.

Private finance would traditionally ignore this hard-to-serve segment in favour of fewer, higher income individuals. Now however, through a combination of technology and regulation following the recovery in the industry from the 2008 financial crisis, that is beginning to change.

For example, in the US it's now possible for employees to roll over from their 401(k) to an Individual Retirement Account if over 59½ years old, while still employed. The incentives for employees to reinvest are clear—many IRAs, as they are known, have lower fees than most 401(k) plans, and there is also no penalty for withdrawing funds from an IRA after reaching the age of 59½, unlike a 401(k).

In the last twenty years, employers have been incentivised to make their pension plans automatic, or opt-out, for their employees. They are no longer held responsible for investment losses from automatic enrollments, with the overall effect that many most eligible employees in the US have a 401(k).

The situation is actually even more significant in Europe, which has the largest mass affluent population in the world, almost double that of the US.

New tech makes wealth management possible at scale

As well as the growth of this customer segment, there are pertinent technological trends in FS that illuminated the business opportunity for Marakon.

Serving large segments like the mass affluent means wealth management providers need to offer advice at a much larger scale than before. Technology like robo-advisers or virtual advisors—in which the qualified human service is retained, but branches are replaced with a centralised hub—are increasingly the norm, allowing providers to serve more customers (at all ends of the wealth spectrum) in a cost-effective way.

For both robo-advisors and virtual advisors, fully automated advice algorithms play a heightened role. These algorithms are based on models like the one developed at Marakon, and they provide the underlying decision engines that help customers make better financial decisions at speed and scale.

The final wider trend is around the new expectations users have for customer experience—for example the ability to access services at their leisure through omni-channel solutions, with seamless CX as the norm.

Translating a detailed model into intuitive CX

To build a best-in-class solution that took all of this into account, whatever we did had to not only help the user identify the best plan for them, but also match their CX expectations, via an elegant and streamlined user journey built on Marakon’s underlying model.

As mentioned, Marakon’s original model was defined in Excel sheets. We determined to develop a deeper understanding of how these models operated, and download from the expertise of the FS team to provide valuable context, before turning it into code.

To help illuminate the best course of action we put together an initial project plan for the wealth prototype project which outlined the goals of the project and the phases of work needed to get there.

Once we had extracted the requisite expertise from Marakon and translated it into a working interface, Marakon could use it use it as an end-to-end prototype. This prototype would be validated by users for Marakon to use as a tool to sell to potential partners.

Exploration, prototyping and testing with real users

We met the Marakon team in New York where we ran through a process of information gathering and where they could share any existing assumptions and hypotheses that might help illuminate the path of product development.

The information gathering covered their target user personas, took a deep dive into the model, and mapped out the relevant stakeholders and business models, finally establishing a process where the two teams could work closely together in a lean way.

We organised workshops with the Marakon team—for product ideation, brand development, and mapping out the assumptions to be challenged and developing a backlog to investigate. From here we developed a definition, strategy and plan for the prototype, and an accompanying process and backlog for delivery of it.

We developed a process of lean product development tailored for the requirements presented to us from Marakon, which we split into two phases—Exploration, and Iterative prototype development. The first phase covered the following: establishing the best customer experience through qualitative anthropological interviews—where feasible or appropriate—and desk research. We would then establish the best technological solution for the prototype.

With the model thoroughly understood and absorbed, we migrated it into sets of robust Python algorithms. Once the model had been coded up, and the requisite understanding had been absorbed, we began developing prototypes to test with real users in the second phase of development.

The second phase, of iterative prototype development is where we defined the prototype, i.e. its core features and strategy, using a working prototype of the financial model. We put together test groups to challenge emergent assumptions, with users based on the personas discussed and decided in the kick off.

A delightful digital solution for finding the right pension

The resulting product delivered to Marakon gives users seeking pensions the confidence and financial security they require, and makes it easy for them to identify the best possible outcomes.

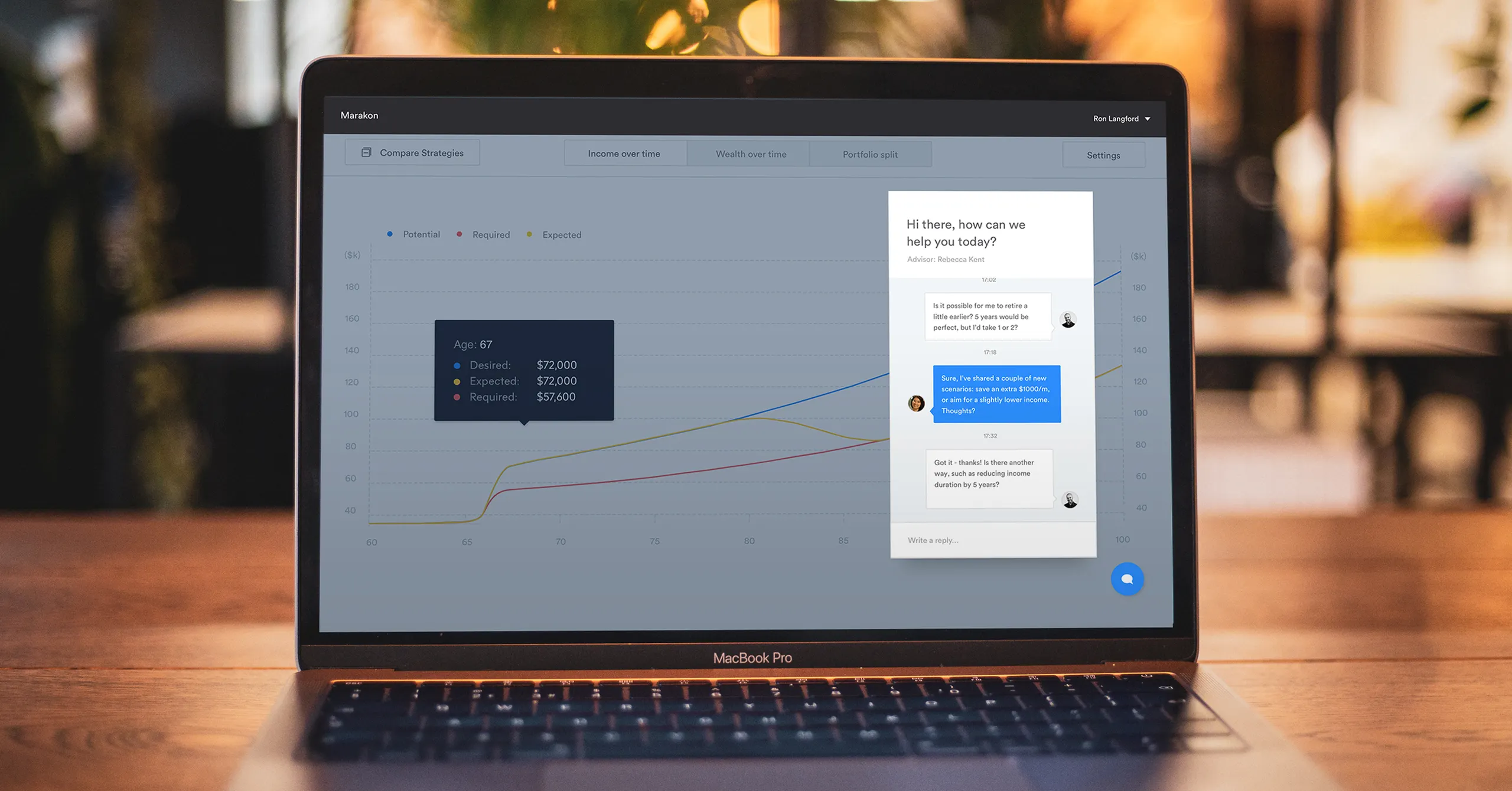

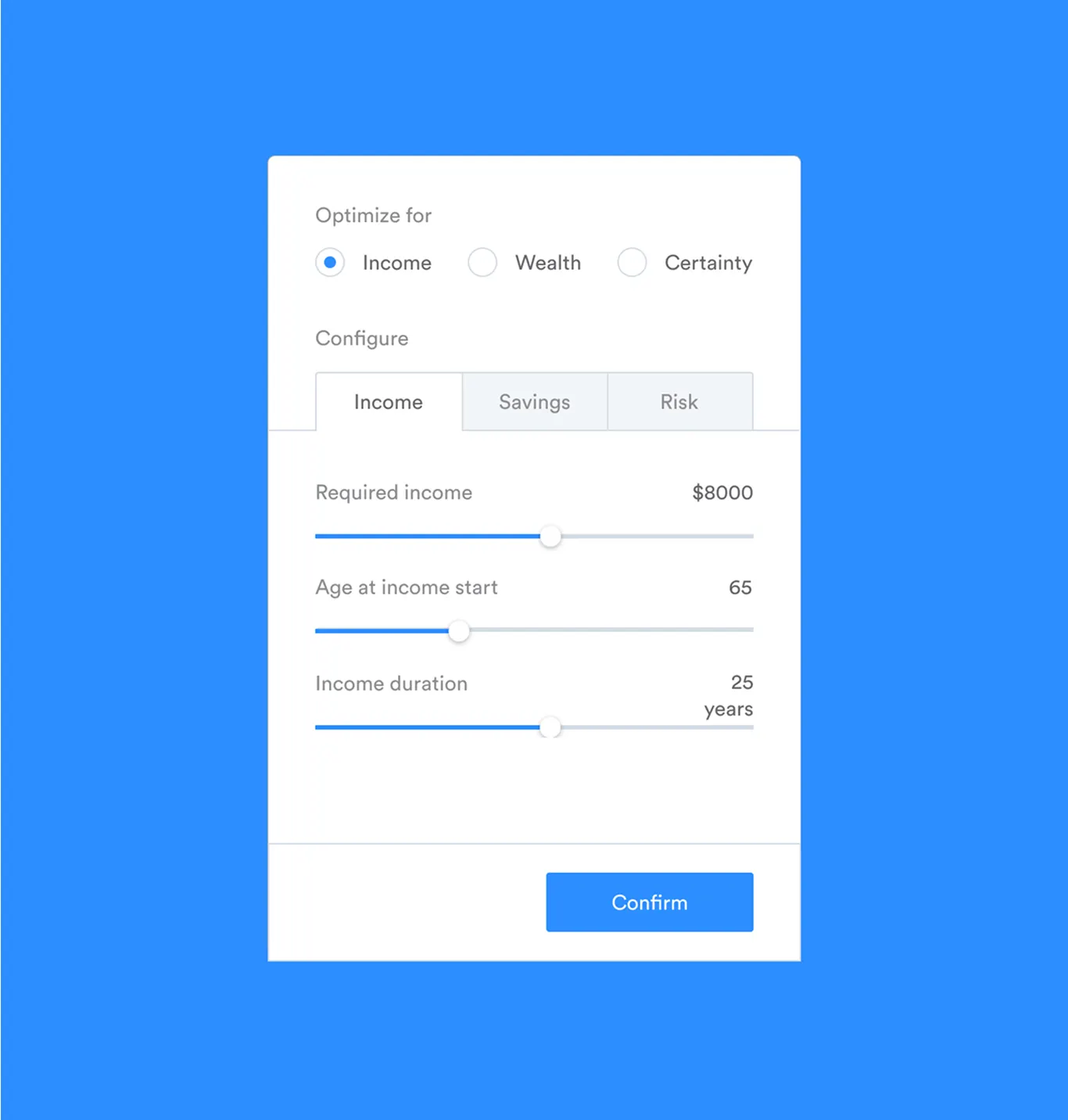

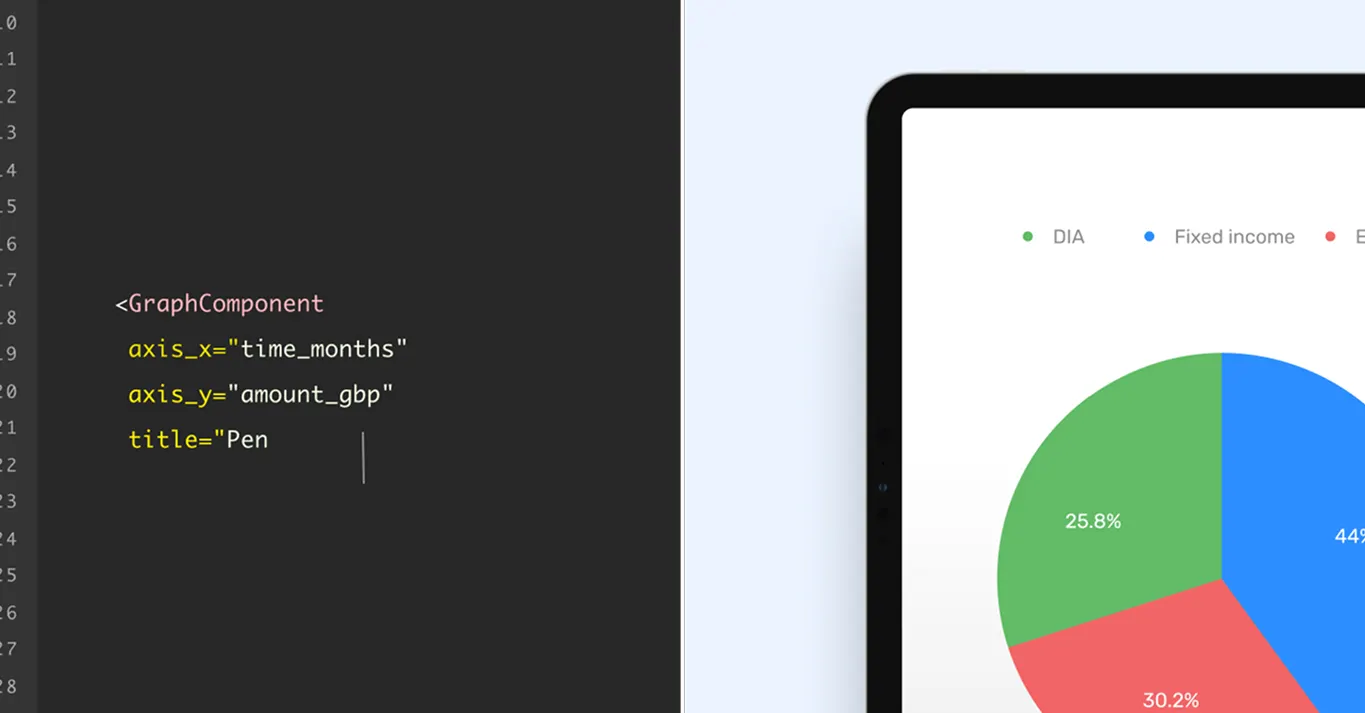

They are onboarded through a simple questionnaire where they set the inputs, landing on the results screen where they can then play around with the inputs and view the data in the form of different graphs to more easily parse the different projections. They can optimise for income, wealth and duration to identify the direction they want to pursue.

As well as an intuitive and seamless customer experience, we were able to deliver a coherent brand feel through the deliverables, which Marakon could take and build on as they saw fit. Alongside this core product, we produced supporting deliverables to Marakon’s specifications—an admin panel and so on—making it easy deliver the service via their partners.

Rapid end-to-end product development

We also received positive feedback on our ability to deliver against a ‘huge scope’—maintaining an open communication between the two teams throughout via the process we established—and that we understood a relatively deep problem space very quickly. The iterated prototypes were robust, with no assumptions left untackled after the target user testing.

This was achieved through a solid plan we established early on, built on cohesive teamwork, quick decision making, and delicate management of a complex stakeholder situation.

Crucially, we were able to deliver against Marakon’s initial vision—giving individuals the same control over their future finances they have increasingly come to expect in their banking. They get peace of mind through the confidence and financial security they require, and are helped to identify the best possible outcome. At the CX layer, they can optimise for income, wealth and duration to identify the direction that’s right for them.

Marakon’s proposed product would challenge the traditional models of the wealth and asset management industry, while adopting the latest standards in customer-centricity, giving it the potential to radically change how customers decide on pensions.